GRUPO LAMOSA, S.A.B. DE C.V. AND SUBSIDIARIES

(Figures expressed in millions of current pesos)

| Results1 | 2019 | 2020 | 2021 | 2022 | VAR % |

|---|---|---|---|---|---|

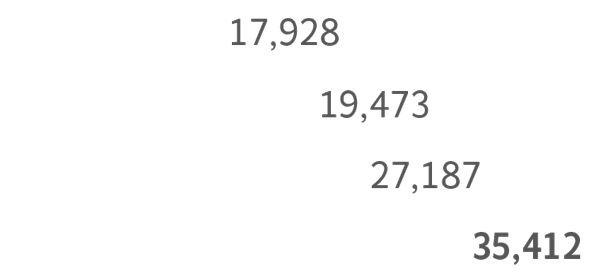

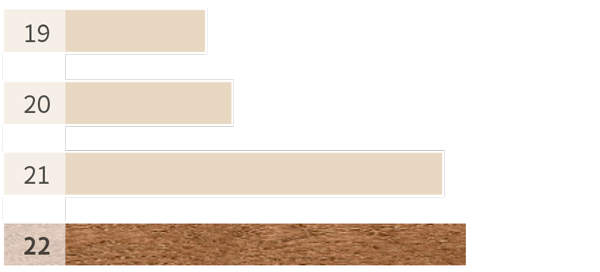

| Net Sales | 17,928 | 19,473 | 27,187 | 35,412 | 30% |

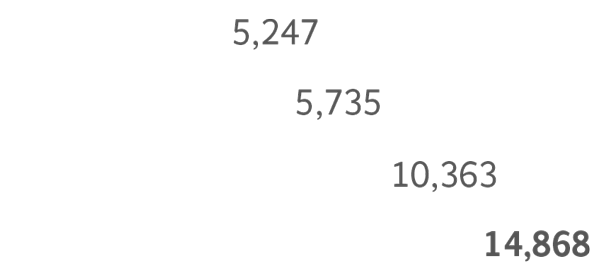

| Foreign Sales2 | 5,247 | 5,735 | 10,363 | 14,868 | 43% |

| Foreign Sales / Net Sales | 29% | 29% | 38% | 42% | |

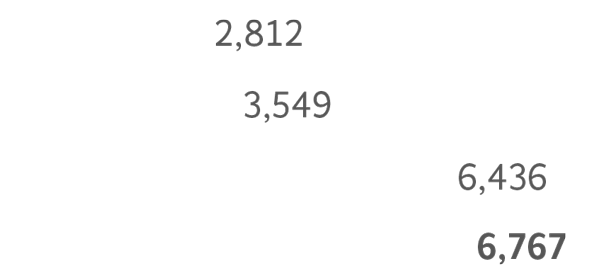

| Operating Income | 2,812 | 3,549 | 6,436 | 6,767 | 5% |

| Operating Income / Net Sales | 16% | 18% | 24% | 19% | |

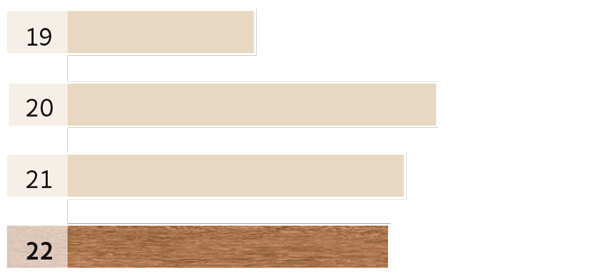

| Comprehensive Financing Cost | 492 | 932 | 719 | 639 | -11 |

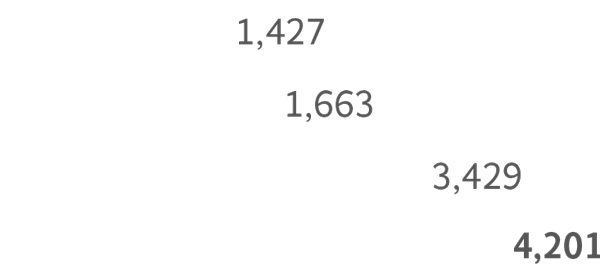

| Consolidated Net Income | 1,427 | 1,663 | 3,429 | 4,201 | 23% |

| Total Assets | 23,247 | 24,633 | 32,360 | 36,051 | 11% |

| Total Liabilities | 13,150 | 13,161 | 19,002 | 20,177 | 6% |

| Stockholders’ Equity | 10,097 | 11,472 | 13,358 | 15,873 | 19% |

| Book Value per Share3 | 26.2 | 29.7 | 34.6 | 41.1 | 19% |

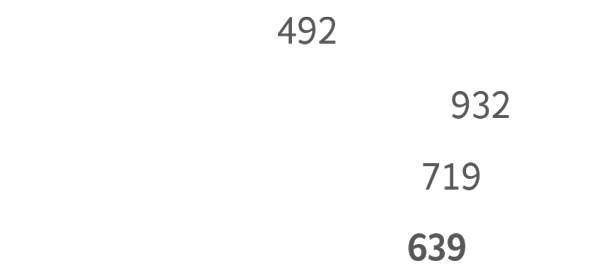

| EBITDA4 | 3,523 | 4,277 | 7,334 | 8,102 | 10% |

| Capital Expenditures5 | 540 | 343 | 5,601 | 4,008 | -28% |

| Total Personnel | 6,725 | 7,325 | 9,737 | 11,299 | 16% |

Net Sales

millions of pesos

+25%

Compound annual growth ’19-’22

+30%

2022 vs. 2021 growth

Foreign Sales

millions of pesos

+42%

Compound annual growth ’19-’22

+43%

2022 vs. 2021 growth

Operating Income

millions of pesos

+34%

Compound annual growth ’19-’22

+5%

2022 vs. 2021 growth

Consolidated Net Income

millions of pesos

+43%

Compound annual growth ’19-’22

+23%

2022 vs. 2021 growth

Comprehensive Financing Cost

millions of pesos

+9%

Compound annual growth ’19-’22

-11%

2022 vs. 2021 growth

EBITDA

millions of pesos

+32%

Compound annual growth ’19-’22

+10%

2022 vs. 2021 growth

WALL AND FLOOR TILES BUSINESS

The tile business posted notable growth in its results for the year, despite a highly uncertain global business context, where, in addition to incorporating Roca’s tile operations in Spain, Brazil and the United States, the segment had to face extraordinary increases in energy, production and transportation costs.

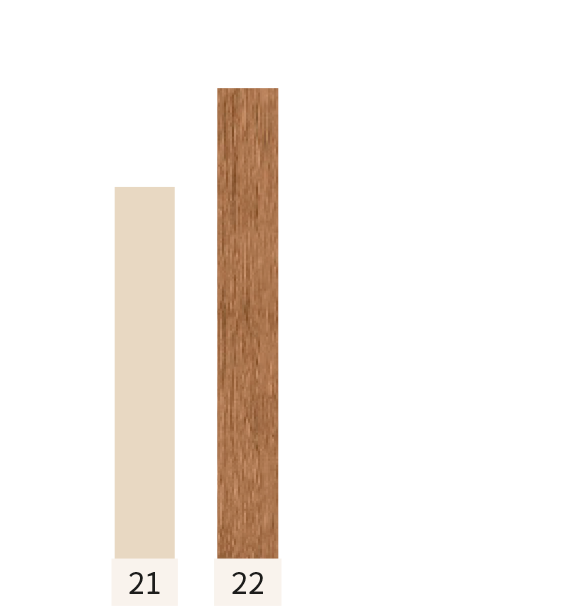

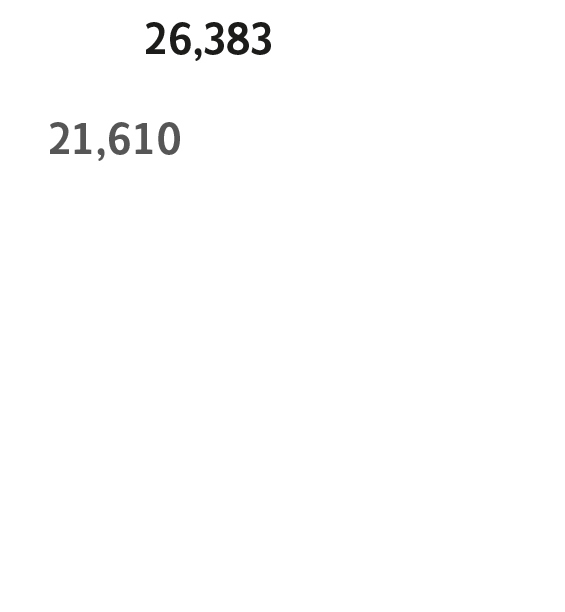

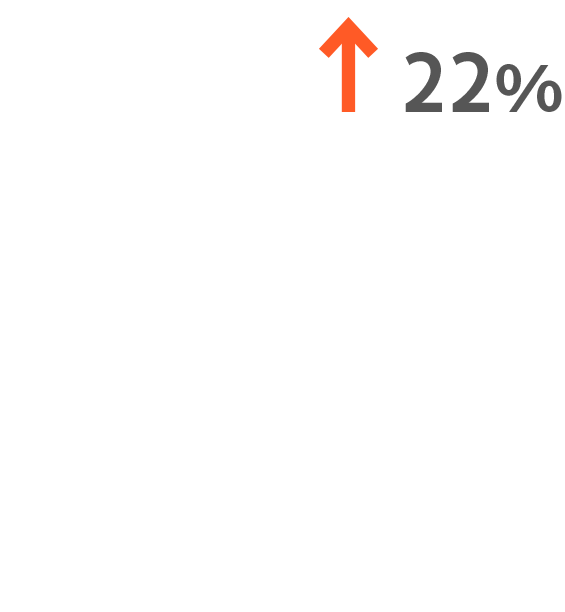

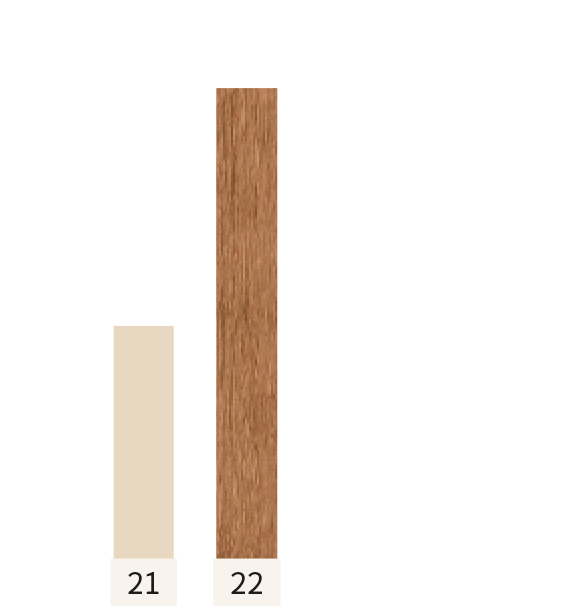

Sales of the tile business grew 22%, to $26,383 million pesos, in 2022.

One of the important challenges that the business faced during the year was the normalization of the consumer spending profile to pre-pandemic levels as COVID intensity declined, particularly during the second half of the year. This implied a slowdown in product demand, which was reflected in distinct ways and rates in the different countries where the business operates.

During 2022, the tile business made a great effort to enhance the digitization of its commercial and operational processes. In the commercial area, progress was made in coming closer to final consumers, through open channels and communication networks that improve the company’s understanding of their decision-making and guide them appropriately. With regard to operations, AI-supported digitalization processes were implemented for all production lines, to measure variables and generate information for better decision making.

Important business events of the year included the Sixth Edition of the Firenze Entremuros Award in Mexico City, as well as the business’s presence and participation in different construction-industry fairs and exhibitions in Mexico and abroad.

Grupo Lamosa’s diversification strategy has given the tile business a great competitive advantage, reducing the risks associated with a dependence on a single market. Additionally, it now has greater operational flexibility and proximity to its main markets, further enhancing its leadership and positioning.

Net Sales

millions of pesos

Net Sales

millions of pesos

ADHESIVES BUSINESS

After an extraordinary year such as 2021, the adhesives business’s 2022 results were impacted by the normalization of sales volumes. Notwithstanding the lower demand and significant increases in the cost of its main inputs, such as cement and chemical products, the segment’s performance was positive and in line with planned objectives.

The acquisition and integration of Fanosa, completed at the beginning of the year through the adhesives business, was an important event that boosted the segment’s results. The business’s 2022 sales totaled $8,981 million pesos, a growth of 61% year-over-year.

One of the adhesives business’s most significant challenges in 2022 was undoubtedly the integration of Fanosa into Grupo Lamosa’s practices and culture. Through a detailed work plan and with the support of teams created in the different areas, new employees with the company’s way of working were identified, enabling the natural flow of the incorporation of operations.

During 2022, the adhesives business implemented campaigns in both traditional and digital media to reinforce the positioning of its brands; participated in the Obra Blanca Expo in Mexico City, which brings together the most prestigious construction professionals and material distributors; and continued to hold product use and application workshops for installers.

Innovation initiatives aimed at improving the environment during the year included the launch of “Oximuro”, a specialized stucco for covering large buildings and infrastructure works that helps to remove air pollutants produced mainly by vehicle engines and industrial activities.

Going forward, the segment’s growth and diversification strategy will continue to bear fruit, enabling it to leverage synergies and participate more fully in the construction materials industry.

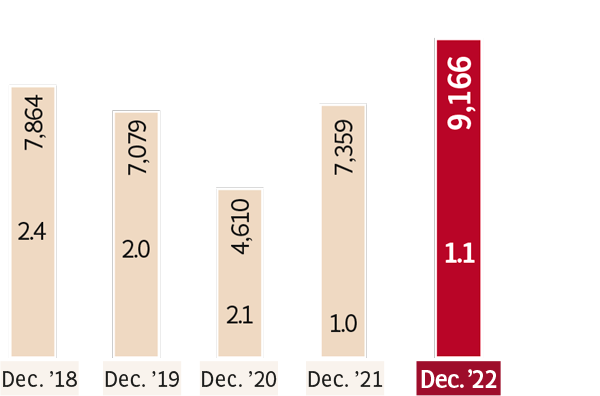

FINANCIAL PERFORMANCE

Grupo Lamosa’s continued financial strength during the year was reflected in outstanding operating growth, higher levels of cash flow generation and low leverage ratios, providing ample opportunity to continue supporting the company’s growth strategy.

Once again in 2022, the favorable financial performance had a positive impact on securities rating agencies’ risk assessment of Grupo Lamosa. HR Ratings upgraded its rating from “HR AA+” to “HR AAA” on a local scale and from “HR BBB” to “HR BBB+” on a global scale, while Fitch Ratings upgraded its rating from “AA-(mex)” to “AA(mex)” on a local scale.

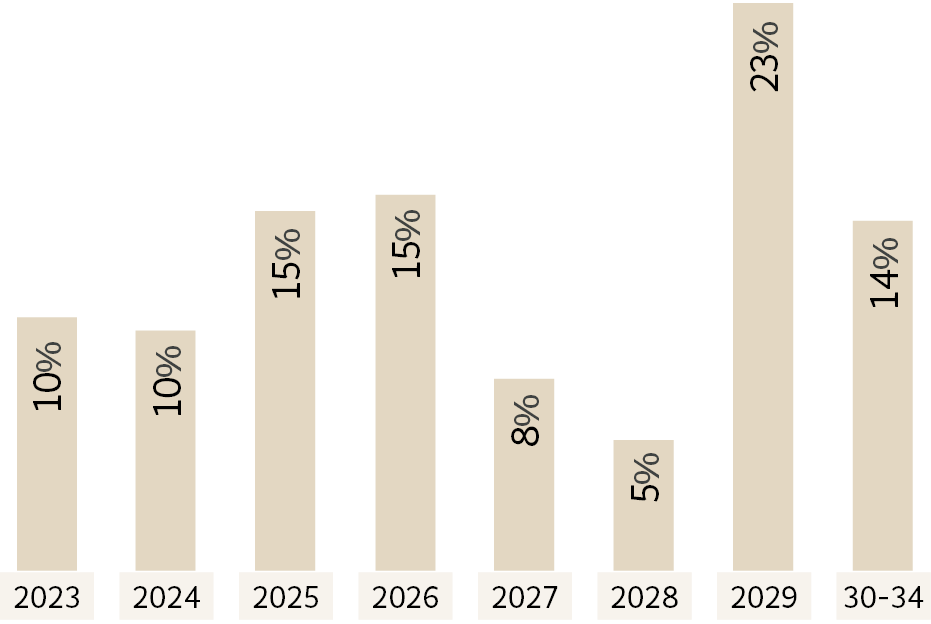

The growth in operating results during the year enabled the company to continue making significant capital expenditures without compromising its level of indebtedness. Investments made in 2022 amounted to $4,008 million pesos, used both for the acquisition of Fanosa in Mexico and for the growth and modernization of diverse production centers in Mexico and other nations. Grupo Lamosa’s net debt as of yearend 2022 was $9,166 million pesos, with a Net Debt to EBITDA ratio of 1.1 times.

In 2022, Grupo Lamosa continued to support the liquidity of the Lamosa* share (single series), through the operations of the Repurchase Fund. During the year, it acquired 5,610,064 shares representing the company’s capital stock, ending 2022 with a balance of 33,521,189 shares in the Treasury.

Grupo Lamosa’s resizing of recent years has given it comparative advantages in the different markets where it participates. The proximity to consumers, product availability and wide value offer of all its products are some of the variables that have enabled the company to face complicated environments better, for the benefit of customers, consumers and all other stakeholders.

Net Debt

millions of pesos

Debt Maturity Profile

Dec. 2022