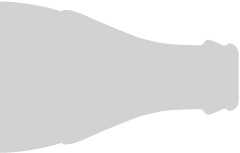

At Coca-Cola FEMSA, our guiding strategic framework incorporates Environmental, Social, and Governance (ESG) principles in two complementary ways. The first is overarching guidance for each of our strategic priorities to ensure that the decisions we make and the resulting changes we drive through these six corridors are sustainable. This ensures that our growth is responsible throughout our organization and serves all of our stakeholders. The second is as one of our priorities—our imperative to make a difference in ESG. We separated this from our overarching guidance of sustainable development because we want to ensure that we are proactive in our approach to become a more sustainable organization. Much more than compliance, our plans for sustainability proactively foster a culture of action.

At Coca-Cola FEMSA, we have a deep drive to improve our environment and the communities in which we operate, and conversely, to understand the impact our environment and communities have on our business. We have established sustainability priorities based on materiality assessments, and shifted our capital strategy to finance our sustainable development, using green and sustainability-backed bonds to finance some of our important work.

Over the last year, we engaged in a comprehensive ESG transformation process involving all parts of our operation. We sought to ensure our practices aligned not only with local requirements, but also with world-leading best practices across industries, so we could establish a new frontier for our local markets on ESG trends and commitments.

We established an ESG Committee, comprised of the company’s senior leadership team1, including our CEO, guided the transformation process and met regularly to make strategic sustainability decisions. To ensure enduring success, senior executives with knowledge of the business and sustainability actively participated in this new vision for change and contributed perspectives from across all areas of our organization.

We based our transformation work over the past year on six guiding principles:

The execution was divided into five distinct phases to develop and refine our sustainability strategy.

For more information see →Sustainability Framework.

Our ESG Strategic Framework

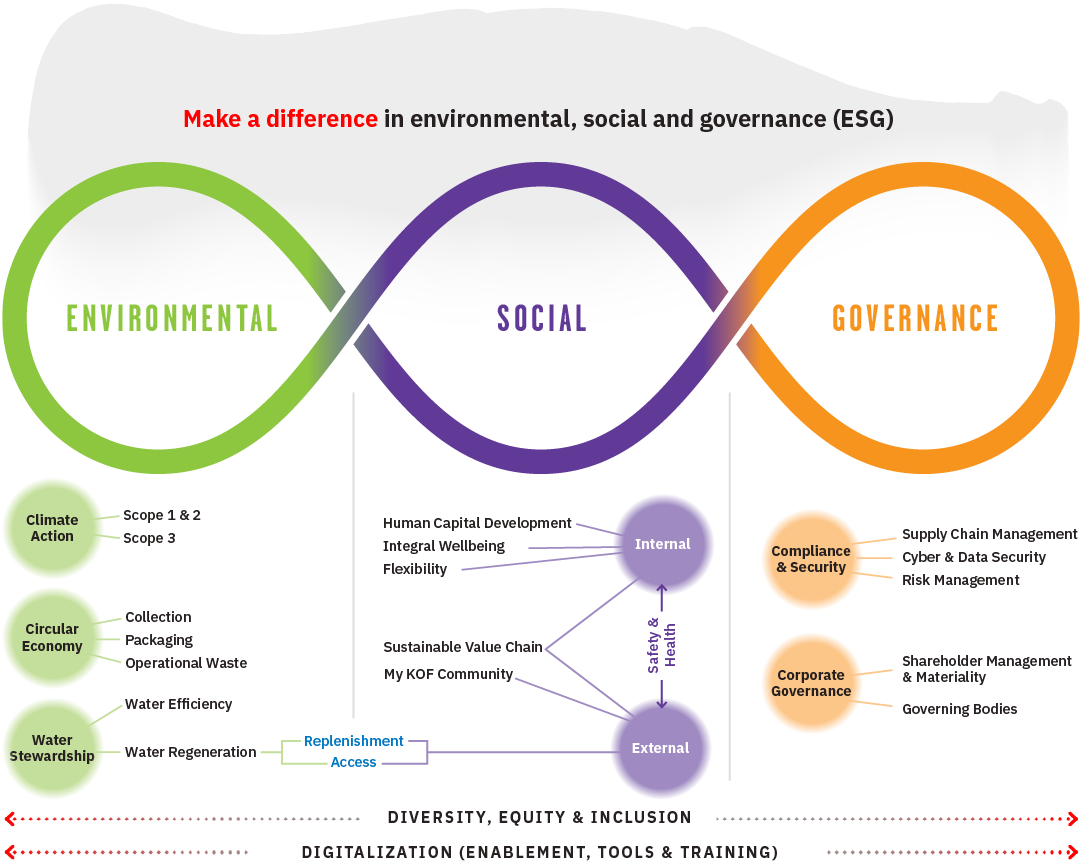

We follow the Science Based Targets initiative’s (SBTi) guidance on reducing rather than offsetting most of our CO2e emissions. We separate our emissions mainly in scope 1 and 2 (direct and indirect emissions from our operations) and scope 3 (indirect emissions from our value chain, covering purchased goods and services provided by suppliers and upstream transportation and distribution). By 2030, to break the ceiling on climate action, we are committed to decreasing our scope 1 and 2 emissions by 50%, and reducing 20% of scope 3 emissions in our entire value chain.

We annually calculate our emissions by evaluating them across various categories, including asset emissions such as our fleet, and emissions from energy consumption in our bottling plants and distribution centers. We also estimate emissions from our value chain, including ingredient and packaging emissions, and emissions from cold drink equipment operations at the point of sale. We also report our emissions to the Carbon Disclosure Project (CDP), following their guidelines to baseline. This ensures that we follow international standards and increase transparency around our sources of emissions and progress to date.

To reach our interim and final ambition on CO2e emission reduction, we have set initiatives to migrate these assets to lower emission alternatives.

| Project | Initiatives | ||

|---|---|---|---|

| A1 | 1 | Fuel substitution in boilers. | Migrate boilers to natural gas. |

| 2 | Energy efficiency in own fleet and fuel-switch. | Improve fleet efficiency. | |

| 3 | Integration of electric vehicles. | Transition of own transport fleet to electric. | |

| 4 | Refrigerant gases management. | Refrigerant gases from sales equipment will be confined and / or recirculated. | |

| A2 | 5 | Energy efficiency in manufacturing facilities | Manufacturing plants will reach their full potential by 2030. |

| 6 | Renewable energy supply | 100% of the electricity requirements will be renewable by 2030. | |

| Project | Initiatives | ||

|---|---|---|---|

| A3 | 7 | Efficiency in third party fleet. | Improve efficiency of the new subcontracted transport fleet. |

| 8 | Energy efficiency of sales equipment. | Improve the efficiency of new sales equipment. | |

| 9 | Sustainable packaging and light weighting. | Achieve 50% rPET content in our packaging by 2030. | |

| 10 | Strategic suppliers development. | Collaborate with our suppliers to improve their emissions per unit of product. | |

| 11 | Renewable energy in SMEs | Migration to renewable energy. | |

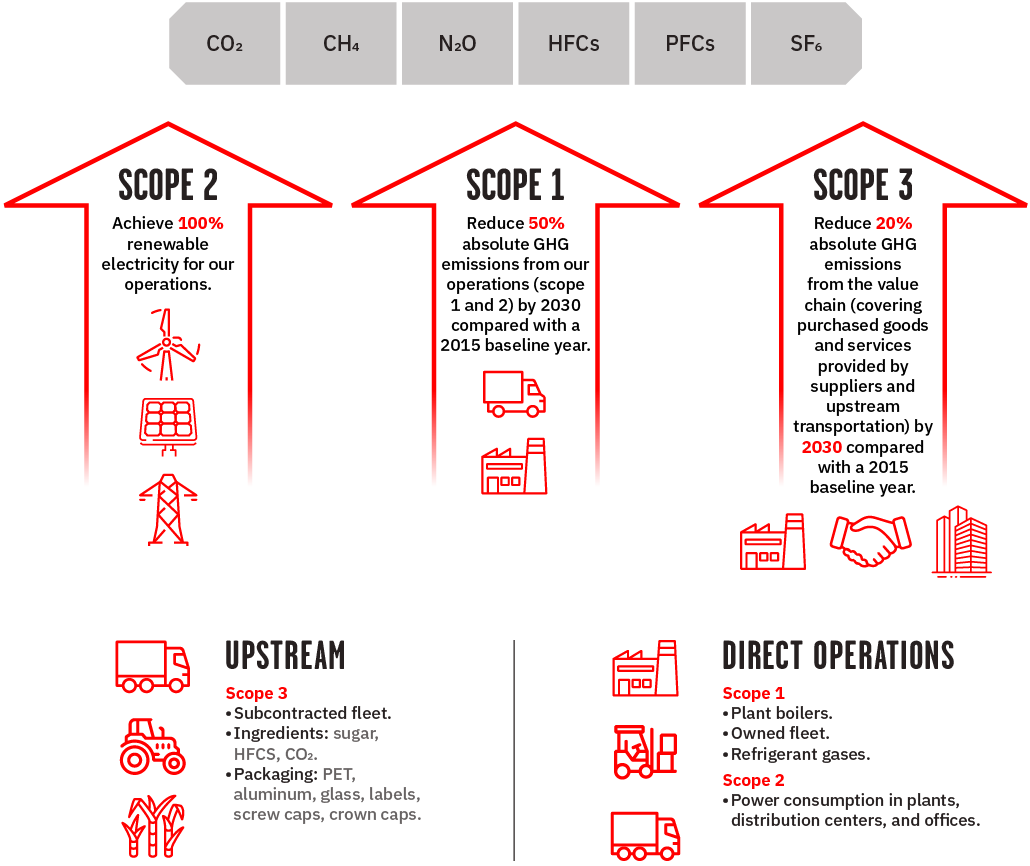

Over the last three years, our scope 3 emissions made up 84% of our CO2e emissions on average, driven by agents across our entire value chain. Our main sources of scope 3 emissions are cold drink equipment at the point of sale, ingredients, and packaging. We set various initiatives to tackle these emissions, many of which require new partnerships along our value chain, and better ways to manage our supply chain.

In 2022, absolute CO2e emissions across our value chain amounted to 3,789 kt CO2e. Our overall value chain emissions are broken down as follows:

Reduce absolute scope 1 and 2 GHG emissions 50% by 2030, from a 2015 base year.

Reduce absolute scope 3 GHG emissions 20% from purchased goods and services and upstream transportation and distribution by 2030, from a 2015 base year.

Increase annual sourcing of renewable electricity from 8.7% in 2015 to 100% by 2030.

Through our Sustainable Mobility Strategy, we aim to reduce the impact of our fleet (including primary and secondary distribution trucks) on the CO2 emissions of our supply chain, and to position ourselves as an industry leader in Latin America in terms of vehicle efficiency, environmental stewardship, and safety.

Aligned with this strategy, our projects are to:

During 2022, we continued to execute route optimization strategies to maximize overall vehicle efficiency. With the deployment of KOF Digital Distribution 1.0 platform in Argentina, Brazil, Colombia, Central America, Mexico, and Uruguay, we installed vehicle telemetry systems on 80% of our primary and secondary distribution fleet.

Thanks to each truck’s telemetry data—together with the functionality of our mobile delivery devices— we enjoy the ability to identify and correct deviations in distribution route execution versus our route plan. This equipment also enables us to analyze route execution patterns in order to identify an optimal combination of variables to improve our route planning process.

As a result, we optimize our fleet’s usage and improve key road safety indicators, while reducing fuel consumption and CO2 emissions. Indeed, we have developed a standardized KPI for fuel use efficiency that will enable us to perform internal benchmarks to improve this indicator moving forward.

Moreover, with the deployment of dynamic routing across our secondary distribution fleet in Brazil, Colombia, and Mexico, we enjoy the flexibility to plan vehicles’ routes on a daily, weekly, and monthly basis, thereby optimizing available fleet resources and distances traveled to serve our customers.

This year, we expanded our fleet of electric vehicles to 482 vehicles. We also significantly expanded our supplier base for electric vehicles in the Latin America region to eight leading global suppliers, working with them to develop electric units that meet the bottling industry’s specifications.

Through our sustainable mobility community, we are working to align the electric vehicle strategy followed across our operations. Within this community, we developed and deployed a total cost of ownership (TCO) and scenarios analysis tool. Moreover, to further align our operations, we developed a standardized protocol to test new electric vehicle technologies—with a standard fuel efficiency KPI to measure fuel consumption by country—to reinforce and improve our migration to electric vehicles. Thanks to these and other initiatives, we will continue our efforts to transition to electric vehicles, prioritizing areas with restricted mobility.

In addition to our sustainable mobility initiatives, we continue to drive down scope 1 emissions from the release of refrigerant gases. We have upgraded more of our coolers at the point of sale to cleaner refrigerant gases, and confined a greater percentage of gases at the end-of-life.

Our scope 2 improvements were led by investments in energy efficiency and renewable energy. We assess our operation’s energy efficiency through an annual energy assessment, understanding sources of inefficiencies and opportunities to drive down emissions. To this end, we invested US$146.84 million in climate action initiatives, focused on operating with steam and executing our Top 20 Energy Efficiency Strategies across our operations. Since 2015, these initiatives have enabled us to increase our energy efficiency to 5.97.

We were also able to increase our use of renewable energy for our operations, achieving 66% renewable energy use.

Scope 3 emissions pose the greatest challenges to our climate action ambitions, and they are the greatest source of emissions in our value chain. In 2022, our scope 3 emissions amounted to 3,182 kt CO2e or 84% of our total value chain emissions. Since 2015, we have decreased our scope 3 emissions by 303.02 thousand tons, leading to progress on our scope 3 ambitions of 17%.

In 2022, we migrated part of our cold drink equipment to high-efficiency versions, enabling us to reduce emissions from electricity use at the point of sale, while benefitting many small and medium-sized enterprises (SMEs) in our value chain by reducing their energy costs.

Moreover, we continue our work with suppliers to reduce our scope 3 emissions. We are integrating scope 3 emissions into our agreements and conversations with suppliers, and are looking for better ways to collaborate with top suppliers and drive down the climate impact of our value chain.

To mitigate the impact of our production volumes, we have set ambitions to collect 100% of all the PET we put in the market by 2030 and to have 50% of recycled resin in our packaging by 2030.

Local market conditions for recycled PET (rPET) collection and recycling differs drastically across our countries of operation, and we are currently evaluating the best approach for collection and recycling in the short term. We recognize that several markets will require us to partner with communities, the public sector, and regulators to ensure our supply of rPET.

Our shift to more sustainable packaging is also driven by adoption of returnable/reusable bottles. As of 2020, the Coca-Cola system had ambitions to reach 25% adoption of returnable/reusable bottles across its network by 2030. At Coca-Cola FEMSA, we have already exceeded these targets—with 31.5% adoption of returnable/reusable bottles for 2022—bolstered by our affordability initiatives and our universal bottle that can be used across multiple beverage categories. →For more information see Portfolio.

Our ambition is to have 100% of our bottling plants certified as zero waste by 2025. While our distribution centers have a longer way to go, we aim to have 100% of our distribution centers certified as zero waste by 2030.

This year, we continued our efforts in PET collection and use of recycled resin across our operations, collecting 26% of the PET we put in the market and using 27% recycled resin across our beverage portfolio. This year, we changed our methodology to calculate our collection rate to only include direct and subcontracted collection, where we are certain as to who collected the material. In terms of direct and subcontracted collection, we collected over 45% more tons of PET in 2022.

We collected more than 80 thousand tons of the PET we put into market in 2022 versus more than 50 thousand in 2021 through both collective and individual action. Ensuring adequate collection across our regions of operation requires us to actively participate in civil and industry alliances. For example, we collaborate with ECOCE, a Mexican civil association that promotes waste collection and recycling, to advance our levels of collection. ECOCE reached a national collection rate of 59% in 2021, on par with the EU.

We also operate through joint collection centers in Brazil, Mexico, and Costa Rica, which enabled us to collect 64,184 tons of PET in 2022.

By joining efforts, we multiply the effects of our actions. Accordingly, we partner with communities, authorities, industry allies, and NGOs on different initiatives to raise awareness of post-consumer waste management, carry out collection and recycling programs within our communities, and inform consumers about the proper disposal and handling of the waste generated from our products.

Across Latin America, we continued to strengthen our sustainable collection capabilities, including the following collaborative initiatives in our countries of operation:

Argentina – We are focused on reinforcing our recycling capabilities in municipalities through programs such as Ruta Verde.

Argentina – We are focused on reinforcing our recycling capabilities in municipalities through programs such as Ruta Verde.

Brazil – During 2022, four collection centers were added in São Paulo, Mutinga, Porto Alegre, and Belo Horizonte.

Brazil – During 2022, four collection centers were added in São Paulo, Mutinga, Porto Alegre, and Belo Horizonte.

Colombia – We expanded our MovimientoRE program, an industry/business alliance to increase the collection of PET in the cities of Barranquilla, Cartagena, Santa Marta, and Cali (through “Cali Circular”), as well as Reciclave Bogotá with the empowerment of recyclers.

Colombia – We expanded our MovimientoRE program, an industry/business alliance to increase the collection of PET in the cities of Barranquilla, Cartagena, Santa Marta, and Cali (through “Cali Circular”), as well as Reciclave Bogotá with the empowerment of recyclers.

Costa Rica – We use green trucks on our home delivery routes to collect PET from the households to whom we deliver our products. We also work, through our Geocycle, Misión Planeta, and industry alliances.

Costa Rica – We use green trucks on our home delivery routes to collect PET from the households to whom we deliver our products. We also work, through our Geocycle, Misión Planeta, and industry alliances.

Guatemala – Some of our programs include cleaning of Río las Vacas, Recíclalos, Casas Verdes, Ecobots, and the beach clean up.

Guatemala – Some of our programs include cleaning of Río las Vacas, Recíclalos, Casas Verdes, Ecobots, and the beach clean up.

Mexico – We opened five new collection centers, so we can increase recycling in the southeast region of the country. We also aligned with small customers, as well as with larger chains, to collect waste at their stores through “Mi Tienda sin Residuos” (“my zero waste shop”) program.

Mexico – We opened five new collection centers, so we can increase recycling in the southeast region of the country. We also aligned with small customers, as well as with larger chains, to collect waste at their stores through “Mi Tienda sin Residuos” (“my zero waste shop”) program.

Nicaragua – Starting in 2021, we established a strategic alliance with Gravita, which operates through a network of base recyclers in several municipalities, guaranteeing the recovery and treatment of PET, so that it can be reused as a raw material again.

Nicaragua – Starting in 2021, we established a strategic alliance with Gravita, which operates through a network of base recyclers in several municipalities, guaranteeing the recovery and treatment of PET, so that it can be reused as a raw material again.

Panama – We formed an alliance with Recicladora Nacional to increase the collection and treatment of PET plastic bottles and create a circular economy for the use of these materials.

Panama – We formed an alliance with Recicladora Nacional to increase the collection and treatment of PET plastic bottles and create a circular economy for the use of these materials.

Uruguay – We have an industry agreement with Crystal PET to close the PET recycling loop through the use of rPET.

Uruguay – We have an industry agreement with Crystal PET to close the PET recycling loop through the use of rPET.

We continued to accelerate our use of recycled resin in our portfolio of beverages’ packaging, with more than 85 thousand tons of recycled resin used in 2022. Most of our recycled resin is acquired from third parties, but we have also continued our joint recycling ventures in Mexico, recycling more than 18 thousand tons of rPET through our IMER plant. We are in the procees of building a new plant “PLANETA”, in Southeast Mexico with and investment of US$70 million.

Overall, our bottles were made of 97.13% recyclable materials this year. We also continue to exceed targets from the Coca-Cola system in sales of returnable bottles, with 31.5% of our sales coming from reusable packaging.

In addition to reducing packaging waste, we have made strides in our operational waste control. We certified 37 bottling plants as zero waste, achieving progress of 77% for our bottling plants. We recycled 98.5% of our industrial solid waste this year, and improved our waste ratio to 6.31 grams of waste per liter of beverage.

We are committed to ensuring the efficient use of this natural resource, conservation of water basins, and safe access to drinking water for our communities and ourselves.

Given the growing urgency of shared water risks and the need for systemic, transversal action across the value chain, our holistic water strategy is focused on four main interrelated elements:

Since water efficiency seeks to minimize our use of the water source, it is a core part of our environmental pillar.

Our main tool to reduce the impact on water reservoirs of our operations is to use less of this resource to produce our beverages. We analyze this through our water use ratio (WUR), which calculates the liters of water required per liter of beverage produced.

We have consistently led our peers in the industry in water efficiency, and continue to invest in minimizing our use of water. For this purpose, we designated our first issuance of sustainability-linked bonds in Mexico for Ps. 9,400 million to improving our water efficiency. For more information see →Sustainable Financing.

We realize that complacency is ineffective to stave off the social and environmental impact of water scarcity, and our vision is to continue to break the ceiling on water efficiency. For this reason, we are committed to reduce our WUR to 1.26 by 2026.

This year, we used a total of 30,240.92 megaliters of water, discharging 8,564.43 megaliters back. We treated 100% of this discharged water to quality levels that could sustain aquatic life.

| Megaliters of municipal water |

Megaliters of rainwater |

Megaliters of well water |

Megaliters of river water |

Total water consumption (ML) |

|

|---|---|---|---|---|---|

| Total KOF (ML) |

9,315.6 | 10.3 | 19,278.4 | 1,636.6 | 30,240.9 |

| Megaliters of water discharged to sewers |

Megaliters of water discharged into rivers |

Total water discharged (ML) |

|||

| Total KOF (ML) |

3,940.9 | 4,623.5 | 8,564.4 |

We invested a total of US$7.07 million in water efficiency programs to reduce our water use, guided by our “Top 20 Water Saving Initiatives.” Through these initiatives, we continued to improve our water efficiency to an industry leading level of 1.46, down from 1.47 in 2021.

We invested a total of US$7.07 million in water efficiency programs to reduce our water use, guided by our “Top 20 Water Saving Initiatives.” Through these initiatives, we continued to improve our water efficiency to an industry leading level of 1.46, down from 1.47 in 2021.

Water is a vital resource for life on the planet, and we must work to conserve this resource in the same environment where we operate. With this in mind, we defined a social water stewardship strategy to guarantee this resource for current and future generations. To develop this strategy, we conducted a cross-sectional analysis of water risk within our company, supported by our partnership with The Coca Cola Company, FEMSA, FEMSA Foundation, The Coca-Cola Company Foundation, and various consultancies.

We identified 31 priority sites that operate in areas of high or medium water stress. We set ambitions to go beyond water neutrality and ensure the regeneration and protection of water in these basins. By 2030, our ambition is to replenish 100% of the water we use in our production, focusing on medium and high stress sites.

Water replenishment remains a priority for investment and partnerships. We currently replenish more than 100% of our total water use. During 2022, more than 43 thousand hectares were impacted through conservation, protection, and reforestations projects.

TLALOC Reforestation Project – This project has already intervened in the reforestation of the 1,833-hectare Alto Atoyac Watershed. So far, it has reforested 20 hectares, and restored soil on 130 hectares for the purpose of supplying the Toluca Valley aquifer.

Regenerative Agriculture and Access Program – In collaboration with the World Resources Institute (WRI), the company developed a three-year program to promote regenerative agriculture, addressing water infiltration and quality problems on 200 hectares that support 100 local producers.

Agua por el Futuro (Water for the Future) – Through several conservation projects, this program has replenished 100% of the water that we use in Colombia, Costa Rica, Guatemala, and Panama.

Forest Protection, Agroforestry Promotion, and Reforestation Projects (Guatemala) – One project protects 231.47 hectares of land in the Xaya-Pixcaya Watershed, which provides approximately 30% of the water supply for the Guatemala City metropolitan region. This project has already reforested 51.42 hectares and implemented agroforestry on 8.16 hectares through the planting of hedgerows and trees. Another project protects 218.58 hectares of forestland in the Los Ocote, Teocinte, Las Vacas, and Villalobos East Watersheds in the Guatemala City metropolitan region. This project has already restored 8.4 hectares of forest.

We believe partnerships and industry alliances are fundamental and critical to the success of water projects. Therefore, we always look for the appropriate partnerships with communities, third parties, or other companies. Through the Latin American Water Funds Partnership, we have worked with The Nature Conservancy, FEMSA Foundation, the Inter-American Development Bank, and the Global Environment Facility to develop eight water funds located in basins of interest:

The human right to water is not only essential to live with dignity, but also a precondition for the realization of other human rights.

One of our objectives is to provide water security in the watersheds where we operate. Therefore, we work hand-in-hand with communities, governments, and other institutions to create water resilience that provides for the return of water to nature and ensures a safe and reliable water supply for communities.

With this mindset, we aim to improve access for our communities to safe drinking water. Throughout our cross-sectional water risk analysis, we have identified 17 priority sites for water access, sanitation, and hygiene initiatives (WASH). Currently, we have access projects in Argentina, Colombia, Costa Rica, Guatemala, and Mexico.

We partner with The Coca-Cola Company, The Coca-Cola Foundation, and FEMSA Foundation to co-develop community initiatives and magnify our impact.

For example, Escuelas de Lluvia is a comprehensive program that provides clean water to Mexico schools suffering from water scarcity through the installation of a rainwater harvesting system and the implementation of an environmental education program. This year, we installed rainwater-harvesting systems in 24 schools across 5 Mexican states and supported the hygiene of 2,800 students. Additionally, in Mexico, we developed the Water 4 Happiness program in conjunction with the Coca-Cola Foundation to improve the quality of public water supply sources in the town of Apizaquito, Tlaxcala, Mexico, benefiting 10,200 people.

Similarly, in Argentina, we participated in the improvement of water access infrastructure for the Buenos Aires’ neighborhoods of Tigre and Tuna, benefiting 1,649 people. Also, in Colombia, we partnered with FEMSA Foundation to provide a water treatment vehicle that offered clean and safe water to several communities that have water access difficulties and deficiencies, benefiting 67,907 people. Moreover, in Costa Rica, at Belen (distribution center), we established a new system in order to return clean and safe water to the environment, and built a wastewater treatment system. Furthermore, in Guatemala, we benefitted 105 people through the distribution of Vivienda Digna kits, designed to capture rainwater in various zones across the country that have limited access to drinking water.

Our community engagement priority is called My KOF Community in our ESG strategic framework. This reflects our understanding that our communities cannot be treated as completely distinct from our business operations—sustainable growth for us requires sustainable growth for the communities in which we operate.

We define our communities according to different standards of our proximity and levels of interaction. We are focusing on our local community operations for the purposes of these ambitions.

At Coca-Cola FEMSA, we are determined to advance the development of the communities where we operate. With this in mind, we will collaborate with our communities across all of our operations to develop sustainable solutions that address local needs.

Our activities across our ecosystem include strategic volunteering through our people, enhancing economic development of SMEs within the community, promoting health and minimizing safety issues within our operations, and interacting with local authorities.

By 2030, we aim to have at least one community engagement plan per site to improve our relationships based on our MARRCO (Model for Addressing Risks and Relations with Our Community) methodology. These engagement plans include prioritized activities to support business continuity and contribute to community needs.

This year, we continued to engage with our value chain and communities through investments and social programs, impacting over 331 thousand people’s quality of life and socioeconomic development. We also innovated in our use of sustainable financing to fund our social projects, with social and sustainable bond issuances this year totalling Ps. 6,000 million. →Sustainable Financing.

Our traditional trade channel is a key segment of our value chain that we always look to strengthen through our community projects. We focus on ensuring that these projects are always connected to priority topics for our company, such as water, PET collection, and renewable energy.

We supported our local business owners with several local initiatives across our operations.

We couple our initiatives with elements designed to improve our small business owners’ capabilities with our work on diversity, equity, and inclusion. To this end, we continued our focus on female small business owners through empowerment initiatives that provide business management training to foster the success of their businesses.

In Colombia, our work with programs such as Ruta Tenderos focuses on providing small business owners with access to management advice, information, and training for their businesses in areas such as accounting, PET collection, and economic reactivation. We supported our small business owners improving their credit access, and provided them with training for their personal and professional development through Mujeres Tenderas ICP programs.

In Brazil, we implemented Acelera SC – Rota do Empreendedorismo, a program that contributes to small entrepreneurs’ business innovation processes by fostering the innovation ecosystem, presenting opportunities for more companies to participate, helping small businesses to reposition themselves in the market, promoting networking and co-creation, and expanding the vision of open innovation in companies that are already consolidated or in the process of repositioning. We also supported the use of differentiated credit, and worked on the Empreenda como Uma Mulher initiative, providing specific technical training for women, while developing new work skills.

We further continued our initiatives to support women-led businesses through the Villa Talento program in Costa Rica and Nicaragua; and through the Emprendamos Juntas program in Argentina and Uruguay.

Our Mexico operation partnered with The Coca-Cola Foundation to start the Empoderamiento de mujeres y pequeños negocios program in 2021. The program’s goal is to support the social, economic, and digital development of women and their small businesses—driving their success through a personal-professional training plan. Since its inception, the program has impacted 17,000 women throughout Mexico.

In Panama, we supported their use of cashless and digital capabilities.

In addition to improving our small business owners’ capabilities, we work with them to improve their skills in other aspects of our company’s business. For example, to facilitate PET collection, projects such as Mi Tienda sin Residuos focus on helping our small local business owners or “tenderos” to strengthen their business by incorporating elements that invite the community to participate in waste collection. During 2022, this project supported almost 200 local business owners, while advancing our PET collection priority.

We also work on PET collection across the value chain, working with collectors to improve their capabilities, access to resources and networks, and compliance with local regulations. For example, through the collaboration of companies and associations, programs such as Reciclar Pelo Brazil work to regulate, improve, and professionalize the performance of cooperatives and associations of collectors of recyclable materials, aligned with the National Solid Waste Policy.

We continue to prioritize the safety and wellbeing of our employees, customers, consumers, and communities through our community projects and donations, including special emergencies such as in the aftermath of natural disasters.

During 2022, we provided support to more than 240 thousand members of our communities through donations of our hydration products during natural disasters, as wells as donations for the improvement of public spaces such as parks, sidewalks, and playgrounds in the areas where we operate, among others.

Overall, we managed to benefit over 600 thousand people in our communities through our environmental and social (programs and donations) initiatives, improving their quality of life and socioeconomic development.

Our social commitments also have a strong focus on our employees. As part of our people-centric culture, we have a robust Human Resources Operating Model that manages all aspects of our talent, and our sustainability strategy complements that model with ambitions around our employees’ development, integral wellbeing, flexibility at work, and internal diversity, equity, and inclusion (DEI).

Notably, our sustainability goals within our internal social context are underpinned by our existing integral ethical system, composed of our Code of Ethics, the Ethics Committee, and the whistle-blowing system known as KOF Ethics Line. Our Code of Ethics lays the foundation for our values and behavior, including topics that are relevant to our sustainable talent management such as Human Rights, Inclusion and Diversity, Discrimination, and Violence and Harassment.

We have an ethics committee in each of our territories that guarantees compliance with this code, reports to the Corporate Ethics Committee, and attends to the company’s most relevant ethical situations and complaints. Our whistle-blowing system, the KOF Ethics Line—managed by an external provider—ensures that employees, suppliers, third parties, or anyone with a relationship with Coca-Cola FEMSA can anonymously lodge complaints of non-compliance. Our third-party line management ensures that these complaints are considered fairly, and analyzed by a group of investigators impartially and confidentially.

The strength of our workforce today is a key driver of our growth tomorrow. By 2030, we aim to increase opportunities for our employees to fulfil their individual career needs and be the real protagonist of their own careers.

To enable our development strategy, we are looking at various ways in which employees can sustain continuous career development. Careers require opportunities, and we are aiming to increase the internal career mobility opportunities across various company functions, countries, and business units. We also realize that development requires tools to perform well, and we have set ambitions to maintain annual training hours at best-in-class levels across contribution levels and gender.

Engaging career development offers the potential to improve our employee retention, and we consider this one of our key metrics to improve. We will continue analyzing strategies for retention through human capital development to sustain our human capital ambitions.

Focusing on our employees’ and their families’ wellbeing is where we all win. By 2030, we want to foster a culture of wellbeing based on a holistic view of self-care and prevention.

Our wellbeing ambitions include helping our employees to lead meaningful lives. To this end, we invest continuously to ensure our people enjoy the opportunity to volunteer in environmental or social initiatives, and make an impact beyond their direct job function. We also aim to improve our employees’ physical and mental health, as measured by our rates of absenteeism and lost time due to illness, and the overall rate of serious illness in our workforce (i.e., regardless of impact to operations).

Our wellbeing initiatives should be accessible to our people across our various geographies, functional areas, and levels. Accordingly, we are working to ensure that our programs cover more of our workforce every year, and that more employees leverage these programs.

For more information see →Social Development, Occupational Health & Wellbeing.

Flexibility is a mindset that extends throughout our operations. By 2030, we aim to ensure that our employees have more control over their life, along all of the different steps of their work experience.

We understand that flexibility at work is of utmost importance to many of our employees, and effective flexibility programs can increase workforce productivity, wellness, DEI, and improve our competitiveness in our talent market.

We are working to define concrete ambitions around flexibility next year, understanding the needs of our administrative employees, and evaluating the feasibility of expanding flexible work options for our frontline employees in the medium term.

Diversity, Equity, and Inclusion (DEI) has implications for initiatives involving our internal social, external social, and governing bodies topics. For this reason, it is one of our transversal topics contained in our new ESG framework. However, we have concentrated our DEI ambitions so far on our workforce, building a steady path towards becoming a more inclusive and diverse organization.

Our talent should mirror our market and business. As a company, we aspire to be an organization preferred by diverse talent for our ability to grow and support all of our employees.

This year, we have focused on the representation of women in our workforce across all of our organizational levels. By 2030, our ambitions are for women to represent 40% of our leadership and management positions. Additionally, aligned with our commitment to DEI, we will continue to ensure that our initiatives and programs enable us to attract, develop, and retain diverse talent into our workforce, including people with disabilities, ethnic, and economically vulnerable groups according to each country’s priorities. For more information see →Diversity, Equity, and Inclusion.

As part of our commitment to business ethics, we continued to utilize our integral ethical system across our organization, with all of our employees signing the Letter of Compliance to our Code of Ethics, ensuring that they understand the Code of Ethics and are aware of KOF Ethics Line. We received a total of 1,371 complaints this year through this system, none of which were related to Human Rights violations.

This year, we evolved the management of our integral ethical system—migrating from a focus on reports from KOF Ethics Line to an integrated vision that brings together key elements that guide us towards prevention, surveillance, detection, and response to ethical dilemmas. Through our management model, we gave our strategy the impulse and systemic approach, as well as the empowerment that our organization requires.

In addition, we now employ more solid mechanisms that enable us to comply with our integrated ethical vision:

We continue to drive human capital development together with our priority to strengthen our Customer-Centric Culture. This year, we expanded our trainings across all contribution levels, providing our workforce with an average of 22.13 hours of training.

Our training this year was a mix of synchronous, asynchronous, digital, and in-person events. We expanded our digital offerings, training 495 leaders through our Agile & Digital Academies. We further continued our Lab Leadership Program to facilitate accelerated talent development for the Supply Chain & Engineering and the LATAM Marketing functions. For more information see →Talent Management and Development.

We expanded our digital ESG training significantly during the year. Through multiple training sessions throughout the year, we trained our top-level of management on our revamped ESG strategy, focusing on developing a comprehensive understanding of ESG and our strategy. We also developed more detailed training programs tailored to different functional areas.

We developed our integral wellbeing initiatives this year, while leveraging feedback from our biennial employee engagement survey, last launched in 2021. We continued to offer our Employee Support program to support emotional wellbeing and consider other aspects of wellbeing in the workplace through our Occupational Health & Wellbeing Management System. For more information see →Occupational Health & Wellbeing.

Our DEI efforts this year were spearheaded by initiatives to attract and retain women in our workforce, with oversight from our Diversity, Equity & Inclusion Advisory Board.

Given the existing gender gap within the industry, we have promoted the representation and inclusion of female talent in a sustainable manner, empowering women to make decisions in key positions and implementing actions to attract, develop, and retain women in front-line positions:

In Brazil, we developed Escuelas de Formación to train female talent within our communities to improve their opportunity to enter the labor force. Additionally, we trained women to perform refrigeration equipment maintenance to promote female participation in technical areas. Likewise, we staffed a new distribution center with 40% female talent since its inception.

In Colombia, we launched the “Cinta Violeta” program, aimed at preventing gender violence within their personal lives and enabling them to share stories in a safe environment. We also expanded the accelerated development of our female talent for leadership roles.

In Guatemala, we set up the first all-female production line, demonstrating that the integration and development of women in operational positions is possible. For more information see →Diversity, Equity, and Inclusion.

We further expanded our efforts for talent recruitment of other underrepresented groups. In Brazil, Colombia, Guatemala, and Mexico, we undertake active recruitment initiatives to improve the representation of people with disabilities in our workforce, with many of our other countries of operations actively working to improve accessibility and inclusion within our workplace. We also work to improve recruitment of LGBTQ+ talent, and allied with Contratá Trans in Argentina, to improve the inclusion and social mobility of the trans community. To this end, we continued to improve inclusion of these LGBTQ+ communities through ally pledges, affinity groups, and consciousness and awareness programs across our countries of operations. In addition, we continued talent programs to attract and retain indigenous, afro-descendant, and economically vulnerable groups into our workforce.

Our ambitions across health and safety are both internal and external—they are relevant to our people, our third-party partners and contractors, and our neighbouring communities.

Coca-Cola FEMSA’s Safety 0.0 Strategy is based on the understanding that safety is a fundamental value and element of our ambitions and organizational strategy. We believe and understand that nothing is more important than the safety and wellbeing of our people.

Our overarching safety vision is “zero is possible.” We aim to cause no harm or injury while people manufacture or supply our products or provide any of our services. To achieve this goal, we prioritize safety and give it high organizational relevance, empowering our leaders and recognizing that each employee is a fundamental contributor to our physical and psychological safety.

To ensure the safety of our operations and the places where we operate, we focus on ensuring the safety and reliability of our people and our work environment. Our comprehensive safety strategy is designed to develop the necessary capabilities and processes that will enable us to systematically reduce our accident rates and continue to achieve our commitments.

Our safety strategy includes five strategic pillars with 13 strategic actions associated with our key activities. We have also developed seven key initiatives and considerations needed to achieve these ambitions.

STRATEGY & DELIVERABLES

We continue to focus on key programs and initiatives that have contributed to significant improvements in our safety performance over the past few years. While we continue to improve on traditional metrics, we recognize that we still have a major challenge to enable “zero” in our operations, which requires ongoing focus and initiatives to sustain our desired results. Common across these initiatives are efforts to improve capabilities, technology, accountability, communications, and other processes that can drive down our incident metrics.

In 2022, 365 million kilometers were travelled in the 9 countries where we operate. Our Safety RTM 0.0 route-to-market, distribution, and logistics safety initiative has already reduced several of our road incident rates. From our people’s perspective, our focus is on developing the skills and behaviors we need to develop professional experts capable of anticipating and preventing incidents. In addition, we aim to ensure the infrastructure and safety elements of our vehicles, developing the processes and environments necessary for our workforce to manage the risks they face every day. This strategy has required us to accelerate our road safety investment to develop the capabilities of our employees and third parties and to acquire equipment such as road simulators, advanced telemetry systems and monitoring devices, and safety vehicle infrastructure. We continuously look to discover best practices and improve road safety in the many communities and countries where we operate, proactively sharing our knowledge with external entities that can enable these practices to be deployed more widely—from our communities to companies, governments, and non-governmental organizations.

By 2030, our goals and ambitions are to achieve zero fatalities, while reducing other incident metrics.

2025 public goals:

In addition to these safety practices, we have developed ambitions around our talent’s health and wellbeing, including other forms of occupational safety. For more information see →Occupational Health & Wellbeing.

This year, we continued executing our safety strategy and revamping our safety organization, helping us to improve most of our safety indicators. We redesigned our organization in 2020, and as of this year, implemented 90% of our new structure.

In 2022, we achieved a lost time incident rate of 0.61. Our total incident rate decreased 13% this year, achieving a rate of 0.90—the lowest in our company’s history.

Since 2016, we have reduced fatalities involving our own vehicles or personnel by 85%. This year, we also decreased our crash rate by 20% year over year to 7.90, and our major crash rate by 27% year over year to 0.61.

Among our key initiatives for decreasing fatal and serious incidents in plants, distribution centers, and RTM, we continued to deploy our “14 Life Saving Rules.” To ensure successful implementation and evaluation of our “14 Live Saving Rules,” each operating unit—manufacturing, warehouses, distribution, and sales—performs a quarterly evaluation on the progress of their action plans. In 2022, 100% of our operating units conducted this self-diagnosis, and the level of implementation was 84% for our manufacturing plants and 67% for distribution centers.

We continued with the certification of our Safety and Health System in manufacturing plants based on the ISO 45001 standard, and we improved the performance of external audits by The Coca-Cola Company. In 2022, we achieved a 25% decrease in major and critical findings compared to 2021. This year, a new safety audit model was incorporated throughout the system that includes elements of compliance, safety strategy-based management, and culture and leadership. Under this new model, 66% of the operations had satisfactory results, and 33% of the operations had opportunities for improvement. At the corporate level, FEMSA’s internal audit had zero findings.

We continued the implementation of our Incident Management Process, contemplating a differentiated classification by four levels of incidents to manage and learn based on risk consequence and probability. Thus far, 100% of our operations have already migrated and implemented this new standard of Incident Management and Prevention for Serious and Potentially Serious Incidents.

Starting in 2022, we expanded beyond our traditional metrics, incorporating objectives and leading indicators related to Serious and Fatal Incidents and Potentially Serious and Fatal Incidents. These leading indicators are designed to help us detect risks and manage mitigation strategies for serious incidents. Our Behavior-Based Safety program is linked to this metric, and employees are now contributing to a reduction in this indicator across the organization. In 2022, a baseline of Serious Incidents and Potentially Serious Incidents was built and is now included in our performance tables.

In our manufacturing operations, the main risks are related to machinery intervention and hazardous energy management. To minimize and eliminate these related risks, a global initiative has been developed, and US$20 million will be invested over 2022 and 2023 to ensure successful implementation. Developed during 2022, this global initiative consolidates risk analysis, capability building, implementation of active and passive safety infrastructure, maintenance, and audits.

As part of our training, we continued to provide and develop new training programs relating to safety. We developed six safety modules for our QSE Academy and 20 modules for our RTM Academy, which will be available for implementation across all of our operations during 2023. The main topics for 2022 were road risks—focused on motorcycle safety and transport vehicle driving—and essential topics such as Safety Fundamentals, Safety Culture, Serious and Fatal Incident Prevention Program, and Roles and Responsibilities.

Road simulators are among our main capabilities development tools that we aim to implement across our operations. In 2022, we invested over US$2 million in simulators, with more than 10 in operation. These simulators enable us to imitate the handling of heavy vehicles (primary and secondary fleet); motorized vehicles (motorcycles); work at elevated heights; emergency situations in critical systems; and other relevant operational processes. To further develop this infrastructure, we acquired road simulators in Argentina, Brazil, Guatemala, Mexico, and Uruguay this year. Through this continuous investment, we have become not only one of the private companies with the highest capacity for simulation training, but also an industry benchmark for safety simulation.

Unfortunately, over the past year, 38 people died either through their work for Coca-Cola FEMSA or community members involved in an incident with one of our vehicles. Any fatality is unacceptable, so we will not be satisfied until we fulfill our promise of ZERO incidents. We extend our condolences to all of the families and everyone affected by our operations, and we are committed to implement best practices to prevent any losses in the future.

This report documents the total number of fatalities (with or without legal responsibility where we were somehow involved during 2022). Importantly, we include any fatalities involving our own personnel, third parties, and communities, integrating all of our operations—manufacturing, distribution, and commercial locations operated by our own personnel, contractors, and third parties.

| 2016 | 2017 | 2018 | 2019 | 2020 | 2021 | 2022 | |

|---|---|---|---|---|---|---|---|

| Total Fatalities | 54 | 37 | 26 | 24 | 30 | 17 | 38 |

| Fatalities w/Responsibility | 9 | 9 | 6 | 8 | 8 | 5 | 4 |

| Year | KOF Collaborators | Third Parties | Communities |

|---|---|---|---|

| 2016 | 6 | 9 | 39 |

| 2017 | 3 | 5 | 29 |

| 2018 | 3 | 4 | 19 |

| 2019 | 2 | 0 | 22 |

| 2020 | 4 | 3 | 23 |

| 2021 | 0 | 5 | 12 |

| 2022 | 0 | 4 | 34 |

Governance plays an enormous role in ensuring a company is sustainable. Without effective governance, companies risk not following through on their sustainability ambitions, engaging in behaviour that can intentionally or accidentally damage their reputation, and ignoring their stakeholders’ priority issues. Within the context of sustainability, we view governance as a way to improve our relationship with all of our stakeholders along two key dimensions: engagement and transparency.

Aligned with our goal to break the ceiling on sustainability, we are shifting the ways we engage our stakeholders—moving from compliance with local regulation and investor requirements to becoming more proactive with our sustainability goals. We already have an internal ESG committee at the top management level, including our CEO, and are working to establish clear accountability across areas on our ESG initiatives. We are also setting strong ambitions of leadership on compliance and security topics such as cybersecurity.

Our reporting to external agencies is key. We are reporting our emissions baselines to the Carbon Disclosure Project (CDP). We have also been a part of the Dow Jones Sustainability™ Emerging Markets Index for 10 consecutive years, and consequently, are evaluated annually under the S&P Global Corporate Sustainability Assessment, the leading sustainability metric for companies worldwide. We are also part of the MILA Pacific Alliance Index, FTSE4Good Emerging Index, and the S&P/BMV Total Mexico ESG Index, which require us to maintain high levels of transparency.

As we move from compliance to proactivity, we are changing our approach to standard compliance and security topics around the organization. To this end, we identified three compliance areas with ESG implications for this shift: risk management, supply chain management, and cyber and data security.

Our risk management functions manage the impact that internal and external factors have on our business, identifying both short-term and long-term risks, quantifying their impact, developing mitigation plans, and reporting material risks.

Embedding ESG into these processes requires us to take a longer term and broader view of our operations, considering interdependencies such as the link between regulation and our ability to operate our fleet effectively. Several of our risks can be mitigated through effective ESG actions, and an effective mapping of these risks is crucial to our ESG strategy. Additionally, to improve our levels of transparency, ESG risk management requires proactive reporting, ensuring our stakeholders are aware of our key risks and the actions we take to mitigate them.

To this end, our ambition is to embed a fully mature and industry-leading ESG risk management process, quantifying our ESG impact and reporting these risks to our stakeholders.

As a baseline, during the latest update of our risk and control base, we have identified around 40% of risks that are connected to one or more aspects of ESG.

We also must upgrade our policies on our supply chain partners to enable our sustainability goals. Environmental and social priorities, such as mitigating scope 3 emissions, are heavily dependent on our ability to work closely with our suppliers and innovate in our supply chain. At the same time, we are responsible for ensuring a well-functioning, resilient supply chain to deliver products to our customers, many of whom depend financially on a steady supply.

To manage our supply chain effectively, we are working on implementing several ESG levers, including:

Our ambition is to:

Over the past decade, our business has grown its digital footprint, as we actively pursued our strategic corridor of digitizing our core. Reliable digital platforms enable much of our commercial and sustainable success. Our manufacturing and maintenance programs are built on digital platforms, and our commercial efforts are based on digital point-of-sale management.

While digital platforms enable much of our strategy, we are also responsible for ensuring the security of sensitive data from our customers, stakeholders, and our company. Without effective cyber and data security mechanisms, we risk operational disruption due to ransomware attacks, unauthorized exposure of sensitive information, fraud, and various other disruptive events.

Our efforts to improve our cyber and data security are focused on both protecting our data from cybersecurity attacks and managing our sensitive information ethically. This means that we are considering how we handle information from storage to use, and communicating our data use transparently.

Our cybersecurity operating model is based on an industry best practices framework, which provides a systemic approach that considers controls aimed at prevention, detection, and resilience to cybersecurity incidents. We have governance bodies at different levels, which include the Board of Directors’ Audit Committee, an Executive Steering Committee, and a Chief Information Security officer (CISO) responsible for leading our cybersecurity strategy. Our technically specialized organization that combines our own and third-party technical resources, while considering proper duty segregation between government and operations. A permanent internal audit process specializing in cybersecurity reports directly to the Board’s Audit Committee, and independent firms conduct periodic assessments, enabling us to assess our level of maturity and security posture while providing insights for our investment program. Also, as a reference, we have The Coca-Cola Company’s “Business Resilience Framework,” which provides the guidelines that the bottling system must meet in terms of cybersecurity and resilience. Lastly, we have a permanent cybersecurity program supported by economic and human resources, which aims to achieve constant, positive evolution in cybersecurity and data protection.

Following our theme of moving beyond compliance, our 2030 ambition on this topic is to be recognized as a cyber and data security leader in the Coca-Cola System and our value chain. Internally, achieving this leadership position will require us to improve cyber expertise and visibility in our governance bodies and reach and maintain a cybersecurity level appropiate for our industry and our risk appetite. It will also require external effort, requiring us to extend our cyber risk management to our value-chain partners, and increasing our transparency regarding our governace strategy and risk management.

This year, we continued our initiatives to advance compliance and security topics (risk management, supply chain management, and cyber and data security) to leading levels.

We assessed the criticality of the identified risks according to our current evaluation methodology and considering the mitigating controls associated with each and found that we do not currently have any residual risk at a critical level.

As a next step, we are focusing on a deeper analysis of these risks to guarantee full coverage of the key variables that may contribute to them, enhance our mitigating controls, and improve the methods of communicating them internally to leadership in a timely manner to act.

Adherence to our various supplier guiding principles increased this year as part of our focus on supply chain management. We assessed 665 suppliers under our own Supplier Guiding Principles, ensuring alignment with our company’s operating principles and values across four categories: Social/Labor Rights; Environment; Ethics and Values; and Community.

Coca-Cola FEMSA

| Country | 2015 | 2016 | 2017 | 2018 | 2019 | 2020 | 2021 | 2022 |

|---|---|---|---|---|---|---|---|---|

| Mexico | 100 | 198 | 245 | 172 | 165 | 164 | 143 | 217 |

| Costa Rica | 30 | 120 | 106 | 34 | 41 | 35 | 47 | 38 |

| Guatemala | 49 | 34 | 36 | 35 | 57 | 68 | ||

| Nicaragua | 84 | 94 | 27 | 21 | 15 | 24 | 13 | |

| Brazil | 45 | 66 | 63 | 245 | 266 | 187 | ||

| Panama | 36 | 24 | 30 | 36 | 34 | |||

| Argentina | 31 | 31 | 17 | 42 | 41 | |||

| Colombia | 30 | 51 | 56 | 45 | ||||

| Uruguay | 15 | 27 | 28 | 22 | ||||

| Total | 130 | 402 | 539 | 400 | 426 | 619 | 699 | 665 |

We are also working with more strategic suppliers aligned with The Coca-Cola Company’s Supplier Guiding Principles and Sustainable Agricultural Guiding Principles. This year, The Coca-Cola Company carried out 120 evaluations of suppliers in our system.

The Coca-Cola Company

| Country | 2016 | 2017 | 2018 | 2019 | 2020 | 2021 | 2022 |

|---|---|---|---|---|---|---|---|

| Mexico | 52 | 40 | 59 | 37 | 27 | 130 | 46 |

| Costa Rica | 3 | 7 | 0 | 1 | 7 | 0 | 1 |

| Guatemala | 5 | 8 | 7 | 8 | 7 | 7 | 7 |

| Nicaragua | 1 | 0 | 0 | 1 | 1 | 0 | 1 |

| Panama | 0 | 3 | 3 | 2 | 1 | 1 | 3 |

| Argentina | 11 | 19 | 10 | 10 | 10 | 25 | 11 |

| Brazil | 47 | 102 | 51 | 42 | 57 | 65 | 45 |

| Colombia | 7 | 18 | 11 | 4 | 10 | 25 | 6 |

| Total | 126 | 197 | 141 | 105 | 120 | 253 | 120 |

We encourage the use of our SGP for our Tier 2 suppliers—the suppliers of our suppliers. In 2022, we evaluated 35 indirect Tier 2 suppliers based on our Guiding principles. Since 2018, we have conducted 178 evaluations under these principles.

This year, under our permanent cybersecurity program, we continued implementing and improving controls oriented toward processes, technology, and people. These controls are aimed at prevention, detection, and resilience in the face of eventual cybersecurity incidents.

We continued to provide awareness and training programs among company personnel and encourage safe behaviors, especially regarding social engineering and phishing risks.

Concerning technological controls and processes, we improved our data protection and the security of our infrastructure, systems, networks, applications, and identity and access management. We also continue to strengthen our monitoring, detection, and response capabilities.

Throughout our ESG transformation, we set world-leading ambitions on various environmental, social, and governance topics. However, achieving these goals requires important changes in the way we execute our day-to-day operations, as well as deep mindset shifts. We have already made many of these changes within our operations, but the changes we must make to sustain this strategy will take several years.

Our transversal topics focus on several operational levers and key considerations that enable us to successfully execute our ESG strategy: DEI and digitalization.

Our aim is to ensure that we are proactive in our transversal DEI efforts, while considering the impact our transformation has on diverse groups’ representation and opportunities. Crucially, we are uniquely positioned to significantly improve DEI across our communities and value chain. For instance, our small local business population has a large representation of women, and improving business outcomes in our sustainable value chain actively contributes to better representation of diverse groups. Empowering these diverse groups yields both direct and indirect benefits—improving the lives of diverse populations can improve entire communities through accelerated and more balanced economic development. We have opportunities to identify these groups across all of our work and take actions to improve their opportunities.

Our ability to become more sustainable depends on an array of different processes and groups within our organization, which requires effective tools for knowledge sharing and data capture. Digital platforms, including tools and training, enable quick and effective distribution of ESG information across our organization, as well as access to data that can help us pivot to more sustainable operations.

A crucial aspect of this topic is an effective ESG training program through our online platforms and beyond. Aligned with our Human Capital Development ambitions, we will deliver ESG training that enables our people to understand the ESG impact of their work, and take action to advance our sustainability ambitions. We have already provided several types of ESG training, and our objective is to leverage our digital platforms to cascade this training across all levels of our organization.

Different ESG initiatives can also benefit from increased levels of digitalization, especially our fleet efficiency and electrification initiatives. To this end, we will continue to assess opportunities for increased levels of digitalization that can enable us to reach our different ambitions faster and more effectively.